Fake-O FICO Funk

A flim-flam of phony figures, and how Experian took America for a big ride

. Updated April 4, 2008

|

"The U.S. average credit score is 678." "National Score Index: 675" - Experian (12/28/06) "The U.S. average credit score is 678." "National Score Index: 692" - Experian (7/8/07) "50% of the US population is below 724." - Experian CreditExpert.com Credit Report Guide (12/29/06) "The median FICO score in the U.S. is 723." - Fair Isaac (12/28/06) |

This is a big problem. Consumers who think that the average score is 678 are harmed through their false sense of security. The farce is so out of hand that a company as influential as LendingTree can't even be convinced that they're disseminating misleading information. Or, maybe they just don't want to admit that they got suckered like everybody else by Experian's relentless advertising.

Fair Isaac's spokesman, Craig Watts, answered a few questions.

Is the average FICO score 678?

CW: "The average FICO score is not 678. Fair Isaac prefers to cite the median FICO score which is 723, since knowing the median score is more helpful to consumers than knowing the average score."

Have you ever cited the mean FICO score? In describing the average FICO, have you ever used anything but the median? Has any FICO average you have ever cited ever been 675, 677, 678, 692, or any other number in the 600s?

CW: "To the best of my knowledge, Greg, Fair Isaac has consistently communicated the median FICO score, never the average or mean score. Data analysts here tell me that the median FICO score nationally has consistently stayed in the 715-730 range, so we haven't cited any median FICO score below that range."

This is the story of a winner and a loser. A big, famous, influential credit score, a second banana, and how the little score had a big laugh at the public's expense. Duped. Hoodwinked. Hornswaggled. The British revenge.*

*"We also acquired credit bureaux in Norway and Denmark that year... "

Experian is no stranger to credit scoring, just like the Washington Generals are no stranger to basketball. A comparison the limeys might understand is Dolly the sheep. Experian's score is a fabulous zircon, a CD from China, knock-off handbags, Milli Vanilli and Ashlee Simpson. You get the same experience, but then things go wrong— terribly, terribly wrong.

The FICO and The Fake-O

One is 300 to 850, the other is 330 to 830— no coincidence

The Experian PLUS Score, a third-rate credit score lenders don't use

Experian, by its own admission, says that its PLUS* score is a "consumer-focused credit score" and "was created in response to the need for U.S. consumers to improve their knowledge of credit." This quote says it all: "The PLUS Score is derived from information based on a credit report, using a similar formula to those used by lenders." If they know the FICO formula— in order to be able to say they know their formula is similar— that's a big story. How similar could it be? The FICO algorithm is one of the most jealously guarded secrets in lendingdom.

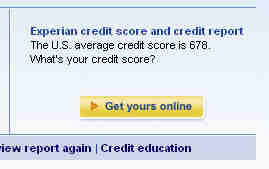

Is there anything more fundamental than a company's home page— the one place where you would expect accuracy? experian.com states, "The U.S. average credit score is 678. What's yours?" (1/13/07).

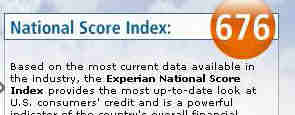

And then— AND THEN, my friend— they have the audacity to turn right around and boldly state, on one of their other many web sites, that the "Score Index" is 675! (1/14/07)(pictures, if you need them).

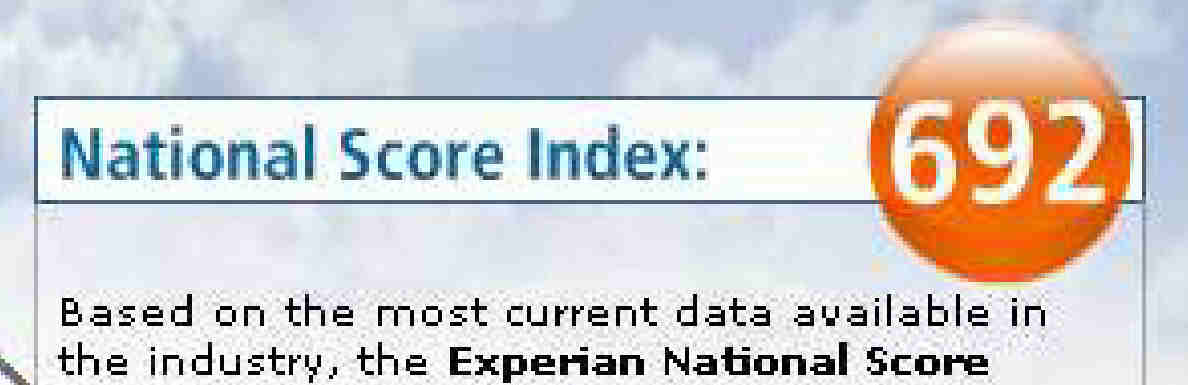

On 7/8/07, Experian's conflicting information says 692 and 678:

Let's see how long it takes them to make the correction. But, please don't expect too much accuracy; they're only a credit bureau, after all.

CNNMoney.com: "Confusion reigns when buying credit scores" - "Buying your credit score is supposed to give you clarity about your creditworthiness. But clarity may be the last thing you'll feel."

Experian ad on Yahoo home page, 7/7/06

Experian National Score Index home page the same day.

LendingTree's hollow message

Creates more myth on a page about myths

Get ready for a walk through LendingTree's funhouse of mirrors.

Facts:

- The FICO score scale is 300 to 850.

- The median FICO score is 723.

On its page titled "Six credit score myths," Lending Tree warns, "Don't be misled by rumors." Its the page with the high search engine ranking.

At the risk of adding to the global confusion, here's the first paragraph:

When you apply for a mortgage, line of credit or even a department-store credit card, the lender will check your credit score. This figure, a measure of your past ability to make payments on time and manage your credit, will be somewhere between 300 and 850, with the average American coming in around 678, according to Experian’s 2005 National Score Index. If your score is too low (most lenders consider anything below 620 to be "sub prime," or higher risk) you may not get the loan you’re seeking or, if you do, it will likely carry a higher interest rate.

The nameless author packs a lot of confusion into a small space.

- National Score Index. Experian states, "The Experian-developed PLUS Score model is a user-friendly, consumer-focused credit score." Translation: Lenders don't use it. They use FICO scores.

- 300 to 850. That's the FICO range. But the median FICO score is 723, not 678.

- 620. The known mortgage loan line in the sand. FICO score again, not the score whose average

iswas 678. - The 678 thing. The really rotten thing about that paragraph is the 678 myth. The median FICO score is 723. But, if you take it from LendingTree, and your FICO is 680, you think you're above average. In reality, you're not in the top 50%. Not the top 55%, either. You ain't even in the top 60%. You're in the lowest 40.

So, LendingTree ("When banks compete, you win"), itself, delivers that big, fat uninformed statement that the rest of the world fell for, the 678 myth, and the beat goes on.

Let's see how long it takes them to come to get real. It's been 5 months, already. Why would they do something like that to you? Oh, come on-- grow up. Here's the big question: Can you tell which score they're selling on their website?

1/22/2007

To: Allison Vail, LendingTree

From: [anonymous email address]

Subject: Average credit score

Cc: Customer care, LendingTree; Bridget Smith, LendingTree

http://www.lendingtree.com... myths.aspx

Please change the sentence, "This figure, a measure of your past ability to make payments on time and manage your credit, will be somewhere between 300 and 850, with the average American coming in around 678."

The median FICO score in the U.S. is 723.

1/22/2007

From: Customer Care, LendingTree

To: "[anonymous email address]"

Subject: LendingTree Customer Service Reply for Case Number: 7567116--------------------------------------------------------------------------

Please retain this line in all replies: Case Number: 7567116

--------------------------------------------------------------------------Thank you for contacting LendingTree. We have received your email and expect to respond to you in approximately 24 Hrs.

You can also visit our Knowledge Center at www.lendingtree.com to find answers to Frequently Asked Questions. The Knowledge Center also contains valuable calculators and articles to help guide you through the loan process.

Thanks again for your inquiry.

Sincerely,

The LendingTree Customer Care Team

From: LendingTree

Sent: Monday, January 22, 2007 6:23 AM

To: [anonymous email address]

Subject: Average credit score Case Number: 7567116--------------------------------------------------------------------------------

Please retain this line in all replies: Case Number: 7567116

--------------------------------------------------------------------------------Dear Valued Customer,

Thank you for contacting LendingTree. I understand that you've found an inaccuracy in our site. We appreciate you bringing this matter to our attention and I will forward this information to the appropriate department for review.

If you are in need of further assistance, please feel free to contact us at 1-888-272-1355. Our Customer Care Consultants are more than happy to assist you and are available 24 hours a day, 7 days a week.

The following survey link will allow you to rate your experience with our Customer Care Department: By clicking, you will be connected to a short survey that will allow you to rate the service you received and make any additional comments. http://rc.realestate.com/axx/applications/surveys/asp/survey.asp?survey=transactional&partner=default&page=1&qfguid=&bguid=&qfid=&bid=&euid=6000&case=7567116

P.S. Need help with tuition expenses for yourself or your child? Get started now with the LendingTree Student Loan Program and get up to $50,000 for college each year. Request private and federal education loans to help you finance an important expense!

URL = http://studentloans.lendingtree.com/index.asp?source=32782&siteid=&esourceid=32782

Thanks again for using LendingTree. When Banks Compete, You Win!

Sincerely,

Michael C

Customer Care

LendingTree

1/24/2007

To: Customer care, LendingTree, Allison Vail, LendingTree

From: [anonymous email address]

Subject: Re: Average credit score Case Number: 7567116

Thank you for your cooperation.

Please correct this statement:

"The number is calculated using a formula created by Fair Isaac Corporation, which is why it's also referred to as your FICO score. is nearly impossible to achieve -- the average score in the U.S. is about 675."

http://www.lendingtree.com... What-the-numbers-mean.aspx

The median FICO score in the U.S. is 723.

1/24/2007

Subject: RE: Average credit score Case Number: 7567116

From: Allison Vail, LendingTree

To: [anonymous email address]Dear [anonymous email address],

Thank you for your inquiry. We looked into the specific data you are referencing and do believe what we have is accurate. With that said, I feel there may be some confusion around using the word average vs. median. Our number is the average, not the median, and what we have is correct.

But you have helped us understand that there may be some confusion with those who read the articles on our site. We are going to look into adding both stats to the articles so there is no chance of confusion or misinterpretation in the future.

Thank you for bringing this to our attention. We hope to clear up the situation in the near future.

Kind regards,

Allison Vail

1/25/2007

To: Allison Vail, LendingTree

From: [anonymous email address]

Subject: RE: Average credit score Case Number: 7567116

The other page says, "This figure, a measure of your past ability to make payments on time and manage your credit, will be somewhere between 300 and 850, with the average American coming in around 678, according to Experian's 2005 National Score Index."

http://www.lendingtree.com/...Six-credit-score-myths.aspx

You added the words, "according to Experian's 2005 National Score Index" since I first contacted you. However, http://www.nationalscoreindex.com/ gives 330 to 830 as the scale. Where did you find 300 to 850?

Who provided the 675 FICO average score statistic at http://www.lendingtree.com/... mean.aspx?

By "average," do you mean the mean, mode, or some other statistic?

Thank you for replying.

1/26/2007

To: Allison Vail, LendingTree

From: [anonymous email address]

Subject: RE: Average credit score Case Number: 7567116

Did you get my email?

1/27/2007

To: Allison Vail, LendingTree

From: [anonymous email address]

Subject: RE: Average credit score Case Number: 7567116

Please reply, Ms. Vail.

1/30/2007

To: Customer Care, LendingTree; Bridget Smith, LendingTree

From: [anonymous email address]

Subject: RE: Average credit score Case Number: 7567116

Cc: Allison Vail, LendingTree

Would you have Ms. Vail reply, please?

_______________________________

Please reply, Ms. Vail.

6/21/2007

From: Greg Fisher (mailto:greg@creditaccuracy.com)

To: GS Partner, LendingTree; GetSmart Affiliate Network; Dale Schultz, GetSmart; Allison Vail, LendingTree; Customer Care, LendingTree; Anderson, LendingTree; David Clark, LendingTree; Jobs, LendingTree; John Marshall, LendingTree

Cc: Craig Watts, Fair Isaac; Barry Paperno, FairIsaac

Subject: GetSmart dumbs down consumers

C.D. Davies, chief executive officer

LendingTree LLC

11115 Rushmore Drive

Charlotte, North Carolina 28277-3442

800-555-8733 (TREE)

Your web site states:

"Credit scores - often called FICO scores - are calculated using all the data from your credit report. The three main credit bureaus - Experian(r) Trans Union(r) and Equifax(r) - may not use the same credit scoring software, so your scores from these three bureaus may be different. Some lenders use one of these scores, while other lenders take the middle score.

"Some of the credit report data that goes into analyzing a credit score are: the number of late payments, the length of time credit has been established, the amount of available credit, the amount of debt, length of time at current residence, employment history and any negative credit issues such as bankruptcies and collections."

http://www.getsmart.com... A-credit-score-primer.aspx

The length of time a person has lived somewhere is not a factor in FICO credit scores. What if a homeless person wanted to get a mortgage loan to buy a house?

First, remove that page until you have checked it for errors and corrected it.

And second, provide the source of that bad rumor so that I can keep them from influencing another unknowing publisher.

6/22/2007

Subject: RE: GetSmart dumbs down consumers

From: Allison Vail, LendingTree

To: "Greg Fisher" (greg@creditaccuracy.com)Greg,

Thank you for your interest in GetSmart and also your inquiry. I've passed along your note to be reviewed ASAP.

Have a great weekend.

Kind regards,

Allison Vail

6/22/2007

To: Allison Vail, LendingTree

From: Greg Fisher (greg@creditaccuracy.com)

Subject: RE: GetSmart dumbs down consumers, January

cc: GS Partner, LendingTree; Affiliates, GetSmart; Dale Schultz, GetSMart, Customer Care, LendingTree; Anderson, LendingTree, D. Clark, LendingTree; Jobs, LendingTree; John Marshall, LendingTree; Craig Watts, Fair Isaac; Barry Paperno, Fair Isaac

1. It is a demand, not an inquiry.

2. You still have not answered the January 25th questions.

3. The false information still exists.

[attached entire January email thread]

7/9/07

7/13/07. NOW, PUBLISHED IN REAL TIME (time to get real):

7/13/2007

To: Allison Vail, LendingTree

From: Greg Fisher (greg@creditaccuracy.com)

Subject: RE: GetSmart dumbs down consumers, January

You are in the feedback loop at http://creditscoring.com/creditscore/other/plus/fake-o-fico-funk.html.

This is like pulling teeth. Currently, your page, "How bad credit affects you" states, "Your credit score is a number between 300 and 850, with the national average coming in around 675."

And, your page, "Bad Credit Can Hurt – GetSmart.com Can Tell You How and Where" states, "The score will fall between a range of 300 – 850, with the national average around 675." (alt)

But, your page "Credit scores: What the numbers mean" says, "According to Fair Isaac, the median FICO credit score in the U.S. is about 720."

So, what in the blue blazes are you talking about?

PS. That's a rhetorical question.

(End of 7/13/07 update. Watch this space.)

7/13/07

More dupes

Others who bought into the 678 rumor

- Forbes: "The average American consumer has a credit rating of 678."

- Marketplace: Interviewee: "The average in America is 678." (author Jason Rich)

- Orange County Register, Sacramento Bee: "He says the average for a credit score is 678 nationally."

- Illinois Association of REALTORS: "The U.S. average credit score is 678 according to Experian’s National Score Index... Once you obtain your FICO score you can work toward improving it."

- Fort Worth Star-Telegram: "Average U.S. credit score: 678."

- Columnist Bob Bruss: "Nationwide, the average FICO score is 678."

- Credit.com: "Currently, FICO reports the median credit score in America as 723 and Experian claims that the average score in the US is around 675."

- CNN: Interviewee: "The national average is actually 678."

8/30/07

692

The update of the PLUS Score average (from 678 to 692) and Experian's suckers

New York Times

3/2/08 - "The scores range from 300 to 850; the average score is 692." (alt, alt, alt, alt)

To: nytnews

nytimes.com

From: "creditscoring.com" (gregcreditscoring.com)

Subject: "MORTGAGES; Repairing Credit Histories," 3/2/08

Cc: tedeschinytimes.com

Date: 3/9/08See:

"New York Times duped. Falls for Experian's fake credit score. Confuses it with FICO and ends up misleading consumers."

http://creditscoring.com/news/2008.htm

Your article states that the average FICO score is 692 ("MORTGAGES; Repairing Credit Histories," 3/2/08).

On August 2, Fair Isaac clarified the issue:

Have you ever cited the mean FICO score? In describing the average FICO, have you ever used anything but the median? Has any FICO average you have ever cited ever been 675, 677, 678, 692, or any other number in the 600s?

"To the best of my knowledge, Greg, Fair Isaac has consistently communicated the median FICO score, never the average or mean score. Data analysts here tell me that the median FICO score nationally has consistently stayed in the 715-730 range, so we haven't cited any median FICO score below that range."

http://www.creditscoring.com/creditscore/other/plus/fake-o-fico-funk.html

You were hoodwinked by Experian. Please publish a correction.

Greg Fisher

3/9/08

3/23/08 - The Times makes the correction

"The Mortgage column on March 2, about credit-repair services, referred incorrectly to the average credit score of 692. That is the average score of consumers evaluated by Experian -- not the average for other credit bureaus or the Fair Isaac Corporation." (alt)

4/4/08